Personal Loan Kya Hota Hai? 2026 Me Interest Rate, Eligibility, EMI – Complete Guide

Personal Loan Kya Hota Hai? Kaise Milega, Interest Rate, EMI aur Best Bank 2026 – Puri Jankari

Personal loan kya hota hai? Eligibility, documents, EMI calculation, approval process aur 2026 me SBI, HDFC, ICICI jaise banks ke personal loan interest rate comparison ke sath complete guide.

Personal Loan Kya Hota Hai?

Personal loan ek unsecured loan hota hai, matlab is loan ke liye aapko kisi bhi tarah ka collateral (ghar, zameen, gold) rakhne ki zarurat nahi hoti. Bank ya NBFC aapki income, job stability aur CIBIL score ke base par personal loan approve karti hai.

Personal loan ka use aap:

- Medical emergency

- Shaadi ke kharche

- Education fees

- Travel / vacation

- Business ya personal needs

ke liye kar sakte ho.

Isliye jab bhi sawal aata hai personal loan kya hota hai, to simple jawab hai – bina guarantee ka loan jo turant mil jata hai.

Personal Loan Lene Ke Fayde

- Bina collateral loan

- Fast approval (kabhi-kabhi same day)

- Kisi bhi purpose ke liye use

- Flexible tenure (1–5 saal)

- Paperwork kam

Personal Loan Ke Types

🔹 Salaried Personal Loan

Private ya government job karne walon ke liye.

🔹 Self-Employed Personal Loan

Business owners, shopkeepers, freelancers ke liye.

🔹 Instant Personal Loan

Digital app ya pre-approved offer ke through.

🔹 Pre-Approved Personal Loan

Existing bank customers ke liye.

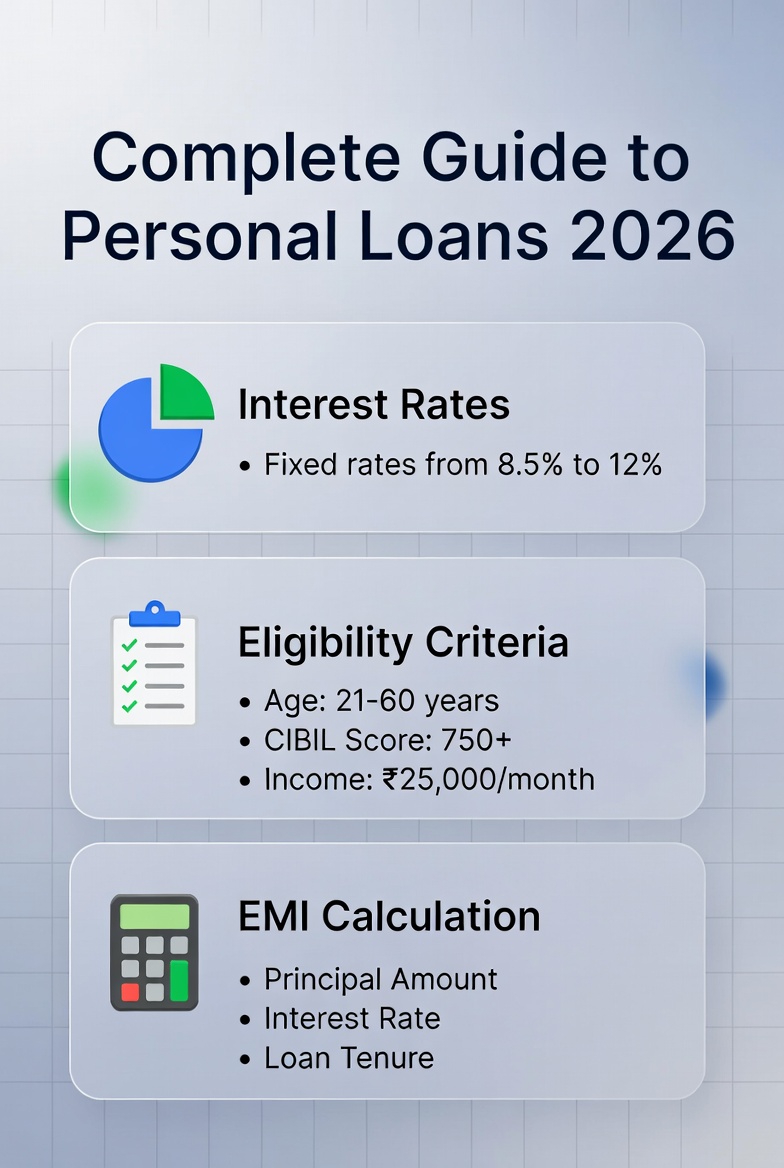

Personal Loan Ke Liye Eligibility Criteria

Agar aap soch rahe ho personal loan kya hota hai aur kaise milega, to eligibility samajhna zaroori hai:

- Age: 21–60 saal

- Minimum salary: ₹15,000–₹25,000 per month

- Job experience: 6 mahine–2 saal

- CIBIL Score: 700+ best maana jata hai

Personal Loan Ke Liye Required Documents

- PAN Card

- Aadhaar Card / Voter ID

- Address proof

- Last 3–6 months salary slip / ITR

- 6 months bank statement

Personal Loan Interest Rate Kya Hota Hai?

Interest rate wo charge hai jo bank aapse loan amount par leti hai.

Personal loan me interest rate:

- Home loan se zyada hota hai

- Credit card se kam hota hai

Interest rate depend karta hai:

- CIBIL score

- Income

- Employer profile

- Loan amount & tenure

2026 Me Personal Loan Interest Rate Comparison Table

| Bank / NBFC | Interest Rate (Approx) | Loan Amount | Tenure |

|---|---|---|---|

| SBI Personal Loan | 10.30% – 14.50% | ₹50k – ₹20L | Up to 6 yrs |

| HDFC Bank | 10.50% – 21.00% | ₹50k – ₹40L | Up to 5 yrs |

| ICICI Bank | 10.75% – 19.00% | ₹50k – ₹50L | Up to 6 yrs |

| Axis Bank | 11.00% – 22.00% | ₹50k – ₹40L | Up to 5 yrs |

| Kotak Mahindra | 10.99% – 19.99% | ₹50k – ₹35L | Up to 5 yrs |

| Bajaj Finserv | 11.00% – 24.00% | ₹50k – ₹40L | Up to 5 yrs |

Interest rate applicant profile ke hisaab se change ho sakta hai.

Government Bank vs Private Bank Personal Loan

Government Bank

- Interest rate thoda kam

- Approval time zyada

Private Bank / NBFC

- Fast approval

- Interest rate thoda zyada

Personal Loan Amount Kitna Milta Hai?

- Minimum: ₹10,000 – ₹50,000

- Maximum: Salary ka 10–20 guna

Example:

₹30,000 salary → ₹3–6 lakh loan possible

Personal Loan EMI Kaise Calculate Kare?

EMI depend karti hai:

- Loan amount

- Interest rate

- Tenure

Example:

₹5 lakh loan, 3 saal, 12% interest ≈ EMI ₹16,600

CIBIL Score Ka Personal Loan Par Effect

- 750+ = low interest rate

- 650–700 = loan milega par rate high

- 650 se kam = rejection chances high

Personal Loan Apply Kaise Kare? (Step-by-Step)

- Bank compare kare

- Eligibility check kare

- Online / branch me apply kare

- Documents verify

- Loan approval & disbursal

Personal Loan Approval Me Kitna Time Lagta Hai?

- Pre-approved loan: same day

- Normal case: 2–5 working days

Personal Loan Charges & Hidden Fees

- Processing fees: 1%–3%

- Prepayment charges

- Late payment penalty

Personal Loan Rejection Ke Common Reasons

- Low income

- Poor CIBIL score

- Zyada existing EMI

Personal Loan Jaldi Approval Ke Tips

- Salary account wali bank se apply kare

- Co-applicant add kare

- Loan amount limited rakhe

Personal Loan vs Credit Card Loan

| Point | Personal Loan | Credit Card Loan |

|---|---|---|

| Interest | Kam | Zyada |

| Tenure | 1–5 saal | Short term |

| Amount | Zyada | Limited |

Personal Loan Balance Transfer Kya Hai?

Mehenga loan saste interest wali bank me shift karna balance transfer kehlata hai.

FAQs – Personal Loan Kya Hota Hai

Q. Bina CIBIL personal loan milega?

Rare cases me NBFC se mil sakta hai.

Q. Minimum salary kitni honi chahiye?

₹15,000 per month.

Conclusion

Ab aap clearly samajh gaye honge personal loan kya hota hai, kaise milta hai aur kaunsi bank best hai. Agar aapka CIBIL score achha hai aur income stable hai to aap easily low interest rate par personal loan le sakte ho.

1 thought on “Personal Loan Kya Hota Hai? 2026 Me Interest Rate, Eligibility, EMI – Complete Guide”