Home Loan Kaise Milta Hai? 2026 Me Konsi Bank Ka Interest Rate Sabse Kam Hai – Puri Jankari

Home Loan Kya Hota Hai?

Home loan ek long-term loan hota hai jo bank ya housing finance company ghar kharidne, banane, ya renovate karne ke liye deti hai. Isme borrower ko fixed ya floating interest rate par EMI me repayment karni hoti hai.

Home Loan Lene Ke Fayde

- Interest rate personal loan se kaafi kam hota hai

- 20–30 saal tak ka long tenure milta hai

- Income tax me heavy tax benefit milta hai

- Apna ghar banane ka sapna aasaan hota hai

Home Loan Ke Types

- Home Purchase Loan – ready ya under-construction flat ke liye

- Home Construction Loan – khud ka ghar banane ke liye

- Home Extension Loan – extra room / floor banane ke liye

- Plot Loan – plot kharidne ke liye

- Balance Transfer Loan – existing loan ko saste interest par shift karne ke liye

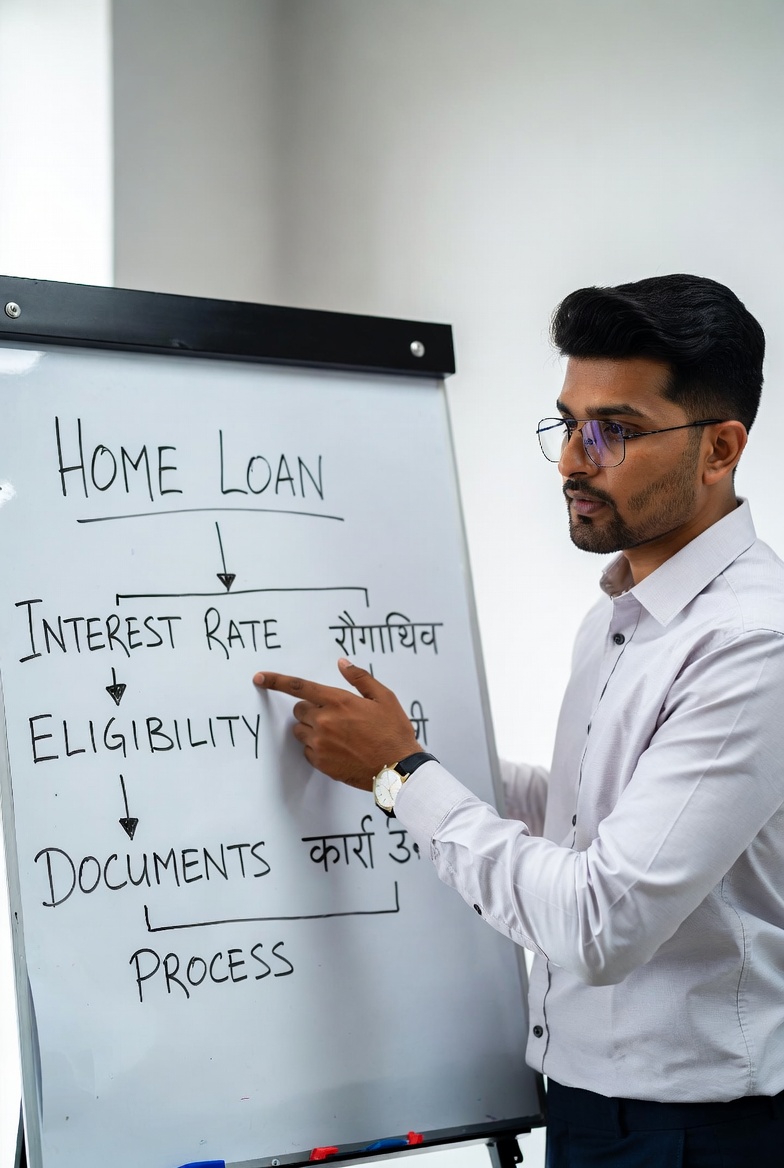

Home Loan Ke Liye Eligibility Criteria

Home loan kaise milta hai samajhne ke liye eligibility jaanna bahut zaroori hai:

- Age: 21–65 saal

- Job: Salaried ya Self-employed

- Minimum income: ₹20,000–₹25,000 per month (bank par depend)

- Work experience: 1–3 saal

- CIBIL Score: 700+ best maana jata hai

Home Loan Ke Liye Required Documents

- Aadhaar Card / PAN Card

- Address proof (Voter ID, Passport)

- Last 3–6 months salary slip / ITR

- Bank statement (6 months)

- Property papers

Home Loan Interest Rate Kya Hota Hai?

Interest rate wo charge hota hai jo bank aapse loan amount par leta hai.

- Fixed Rate: EMI same rehti hai

- Floating Rate: Repo rate ke sath ghat-badh hota hai (zyada popular)

SBI Home Loan: SBI se ₹40 Lakh Home Loan lene ke liye kitni Salary chahiye? EMI kab deni hoti hai?

2026 Home Loan Interest Rate Comparison Table (India)

| Bank Name | Interest Rate (Approx) | Loan Tenure |

|---|---|---|

| SBI Home Loan | 8.40% – 9.15% | Up to 30 yrs |

| HDFC Bank | 8.50% – 9.30% | Up to 30 yrs |

| ICICI Bank | 8.60% – 9.40% | Up to 30 yrs |

| Axis Bank | 8.75% – 9.50% | Up to 30 yrs |

| PNB Housing | 8.45% – 9.25% | Up to 30 yrs |

| Bank of Baroda | 8.40% – 9.20% | Up to 30 yrs |

Note: Interest rate applicant profile aur CIBIL score par depend karta hai.

HDFC Home Loan Guide 2026: Apne Sapno ka Ghar Karein Sach!

Government Bank vs Private Bank Home Loan

Government Bank:

- Interest rate kam

- Process thoda slow

Private Bank:

- Fast approval

- Better digital service

Home Loan EMI Kaise Calculate Kare?

EMI depend karti hai:

- Loan amount

- Interest rate

- Loan tenure

Example:

₹30 lakh loan, 20 saal, 8.5% interest ≈ EMI ₹26,000

CIBIL Score Ka Home Loan Par Effect

- 750+ = best interest rate

- 650–700 = loan milega par rate high

- 650 se kam = rejection chances zyada

Home Loan Apply Kaise Kare? (Step-by-Step)

- Bank compare kare

- Eligibility check kare

- Documents submit kare

- Property verification

- Loan approval & disbursement

Home Loan Approval Me Kitna Time Lagta Hai?

- Pre-approval: 2–3 din

- Final approval: 7–15 din

Home Loan Hidden Charges

- Processing fees: 0.25%–1%

- Legal charges

- Valuation charges

Home Loan Balance Transfer Kya Hai?

Agar aapka existing loan mehenga hai to aap saste interest rate wali bank me shift kar sakte ho.

Home Loan Tax Benefits

- Section 80C: ₹1.5 lakh (principal)

- Section 24B: ₹2 lakh (interest)

First Time Home Buyer Tips

- PMAY subsidy check kare

- Joint loan le

- Down payment kam rakhe

Home Loan Rejection Ke Reasons

- Low income

- Poor CIBIL score

- Property legal issue

Home Loan Approval Fast Karne Ke Tips

- Co-applicant add kare

- Existing loans kam rakhe

- Stable income dikhaye

FAQs – Home Loan Kaise Milta Hai

Q. Minimum salary kitni chahiye?

₹20,000+ per month

Q. Maximum loan amount?

Income ke 60x tak

Conclusion

Agar aap ye samajh gaye ho ki home loan kaise milta hai, to sahi bank choose karke, achha CIBIL score maintain karke aasani se low interest par loan le sakte ho. Government banks interest me saste hote hain, jabki private banks fast service dete hain.

Aadhar Card Se Loan Kaise Le 2025 – Instant Loan Guide in India

2 thoughts on “Home Loan Kaise Milta Hai? 2026 Me Interest Rate, Eligibility, Process – Complete Guide”